Kirinyaga Governor Anne Waiguru (centre) with her colleagues during a past media briefing in Nairobi.

Joseph Njoroge* leans back in his office chair, staring at the notice of sale on his desk with bold red letters at the top of the document feeling like a death sentence.

The January 7 notice shows his 10 acres in Embu will be auctioned because he is unable to pay a Sh15 million loan he secured using the land’s title deed. Five years ago, his firm secured a contract to build ECDE classrooms in a western Kenya county.

It was a lucrative deal, at least on paper. Joseph’s company delivered on time, ensured quality and even handed over the classrooms to county officials in a well-attended commissioning. Yet three years later, he is still chasing his payment.

“I have tried everything. Letters, emails, phone calls and even written a formal demand letter, but there is no response. My creditors are on my back and I am afraid should I go public about my predicaments, I will get a backlash from the county government. But the truth is that I am financially sick despite being owed millions by the county. It is tough doing business with the counties,” Joseph told the Nation.

He is one of the suppliers and contractors facing auctioneers as banks and other lending institutions seize their assets and recover loans, with the backlog mostly affecting micro, small and medium enterprises. For many other contractors, work has stopped and business put on hold as national and county governments and institutions under them hold onto their money.

Joseph had been subjected to at least four verification processes, but even after qualifying to be paid, he has not received a cent.

The Public Procurement Regulatory Authority (PPRA) now wants county governments, county assemblies, public water companies, county corporations, city boards and municipalities to pay suppliers or face severe sanctions under procurement laws.

Delayed payments

PPRA chairperson Mwangi wa Iria told the Nation that the authority has received numerous complaints from suppliers, contractors and service providers regarding delayed payments and unpaid goods and services.

The non-payment, according to Mr Wa Iria, has triggered agony, debt defaults and auctions for many suppliers who had tapped bank or Sacco loans for the contracts. Mr Wa Iria explained that the law requires public entities that payment obligations are met in line with contract terms and conditions. He added that small and medium-sized enterprises and service providers who have no buffers to absorb extended payment terms are suffering a financial squeeze.

“The delays in payments is an obstacle to economic soundness and growth as it impacts several other sectors. Whereas counties have continued to receive their remittances from the Treasury with understandable delays, there’s no justification as to why payments should go beyond 90 days up to inspection and acceptance by relevant persons.

“The authority has opened an online complaint reporting portal for all contractors, suppliers and bidders to report complaints, including overdue payments beyond the spelt out contractual period,” Mr Wa Iria said.

He said the deepening cash flow crisis for businesses due to rising bills has lowered demand for goods and services, making it difficult for firms to sustain jobs.

Many small traders doing business with the counties and state entities have ended up being blacklisted by the Credit Reference Bureau after falling behind in loan repayments or defaulting altogether, hurting their chances of borrowing in the future.

PPRA Director General Patrick Wanjuki, in a circular last Friday, warned county accounting officers to adhere to procurement laws, or those who delay payments will face sanctions. He termed it an offence under the Public Procurement and Asset Disposal Act for accounting officers to fail to honour contractual obligations when they’re due.

30 counties

“The authority notes with great concern that there are many cases of delayed or non-payment to contractors by some county executives, particularly in instances of transition of county leadership. The incoming leadership fails to honour payments of lawfully performed contracts executed by the outgoing administrations and this amounts to an offence under Section 176 of the Act.

“Accounting officers are expected to ensure compliance with this circular in their procuring entities and to note that the authority will take necessary measures on non-compliance without further reference to the procuring entities,” Mr Wanjuki said, in the letter to counties, copied to the Treasury, Controller of Budget, the Auditor General and the Office of the President.

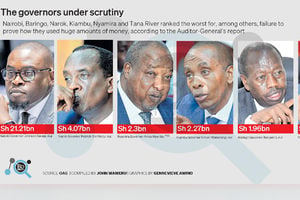

In her latest report, CoB Margaret Nyakang’o says some 30 counties had pending bills above Sh1 billion in 2023–24 compared to 22 in 2022–23. The 30 counties owe suppliers and contractors Sh185 billion, which is 95 per cent of their pending bills.

They are Nairobi (Sh121 billion), Garissa (Sh6 billion), Kiambu (Sh5.9 billion), Turkana (Sh4.7 billion), Machakos (Sh4.42 billion), Mombasa (Sh3.9 billion), Kisumu (2.7 billion), Kisii (Sh2.31 billion), Tana River (Sh2.1 billion), Kilifi (Sh2 billion), and Kajiado (Sh2 billion). The others are Taita Taveta (Sh1.9 billion), Embu (Sh1.91 billion), Mandera (Sh1.83 billion), Migori (1.7 billion), Kwale (Sh1.66 billion), Wajir (Sh1.64 billion), Laikipia (Sh1.64 billion), Bungoma (Sh1.58 billion) and Kakamega (Sh1.56 billion).

“Accumulated pending bills hurt public service and disrupt business operations. Counties are advised to prioritise eligible pending bills as a first charge to their budgets in compliance with the law,” the Cob says.

Treasury CS John Mbadi had said, “Ninety-five per cent of invoices are between Sh1 and Sh10 million, so only five per cent are bills above Sh10 million. The bulk are owed to SMEs.”

*Name changed for personal privacy of the contractor.