The Finance Bill 2025 is shaping up to be one of the most hotly debated pieces of legislation in recent years.

Tax experts have hailed the Finance Bill 2025 as a much-needed “clean-up” of the country's tax laws, although they warn that some proposals could have far-reaching implications for businesses and ordinary Kenyans.

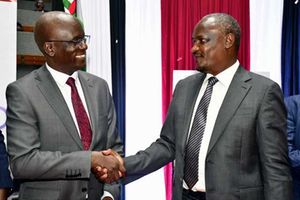

At the same time, Treasury Cabinet Secretary John Mbadi has defended the government’s approach, arguing that bold reforms are necessary to ensure fairness, boost compliance, and put the country’s finances on a sustainable path.

The Finance Bill 2025 is shaping up to be one of the most hotly debated pieces of legislation in recent years. As Parliament prepares to scrutinise the proposals, a spirited national conversation is unfolding—on television, in town halls, and across social media—about what the bill will mean for businesses, farmers and ordinary Kenyans.

On Tuesday night, a high-profile panel discussion brought together some of the country’s leading voices on tax and economic policy. Hosted by Julians Amboko on NTV, the panel included economist Kwame Owino, tax director Jilna Shah, and Public Finance Committee chairperson Robert Waruiru.

Mr Amboko, moderating the NTV panel, echoed the government’s framing. “This is very much a clean-up finance bill. We’re seeing a lot of rationalisation of the VAT Act, and the government is clearly trying to address inefficiencies,” he said.

But the panellists were quick to caution that some of the details were worrisome.

Mr Waruiru, a tax expert who also chairs ICPAK's Public Finance and Taxation Committee, acknowledged the need for reform but warned of unintended consequences. “The bill has sought to rectify so many gaps or so many errors, but we must be careful not to create new problems in the process,” he said.

Ms Shah said, “Moving essential goods like animal feeds and pharmaceuticals from zero-rated to exempt status will increase costs for producers, and those costs will be passed on to consumers. It’s a very worrying concern, especially for vulnerable groups,” she said.

Across town, Mr Mbadi addressed the nation from a Citizen TV town hall, defending the government’s approach and fielding tough questions from the public.

The CS emphasised that the Finance Bill 2025 – which will go through a robust process in public participation and Parliament – is still a draft, and that public participation is ongoing. “We are listening to all views and will make adjustments where necessary,” CS Mbadi repeated. “The final version of the bill will reflect the interests of both businesses and ordinary Kenyans.”

The government says the Bill aims to rationalise the Value Added Tax (VAT) Act and plug loopholes costing the exchequer an estimated sh400 billion annually in tax refunds.

“The intention is not to burden Kenyans, but to ensure that everyone pays their fair share and that the tax system is transparent and predictable,” CS Mbadi said.

A central feature of the bill is the review of goods and services currently classified as VAT exempt or zero-rated. The distinction is crucial: zero-rated goods allow suppliers to claim VAT refunds, while exempt goods do not—often resulting in higher prices for consumers.

Perhaps the most controversial proposal is the plan to give the Kenya Revenue Authority (KRA) greater access to business and personal data through integrated digital systems. The government argues this will improve compliance and reduce tax evasion, but critics warn that it could open the door to abuse.

Ms Shah warned that the move could give tax authorities unprecedented access to sensitive information, including trade secrets and personal data. “The data management system is now going to be integrated with KRA, and the fact is, it’s actually a very worrying concern because they’ll be able to access even your trade secrets—yes, and also personal data,” she said.

Mr Kwame said, “The serious intrusion that’s going to take place—I think this law still has the view that the average business person in Kenya is a crook and you need to be able to go right into their systems every day.”

Mr Waruiru also questioned the necessity of such sweeping access. “Why does KRA need trade secrets? Why does it need personal data which has been acquired in the ordinary course of business?” he asked, highlighting the growing unease over the potential impact on privacy and competitiveness.

But CS Mbadi has criticised efforts to restrict the KRA’s access to business and personal data, arguing that such measures could shield tax evaders. He warned that without clear definitions of ‘trade secrets’ and ‘private personal data’, the Commissioner General would be unable to access any relevant information, undermining tax enforcement.

“This amendment was mischievous in my view—it was denying KRA the opportunity to see people who are avoiding paying tax,” Mr Mbadi said, adding that while ordinary salaried workers are heavily taxed, others with significant wealth remain protected by what he called “mischievous laws.”

He emphasised that data protection principles are already well established in law and cautioned against using them as a cover for tax cheats, noting, “Some of us do not have anything much to hide. You do not have any secrets, let alone trade secrets. It is unfair, immoral, and should not continue.”

The tax experts also criticised frequent changes in tax policy.

“Every year, we see new rules and reversals. It creates uncertainty and makes it difficult for businesses to plan for the long term,” said Mr Waruiru.

The Bill was praised for including some measures aimed at easing the financial burden on citizens. Pensioners would benefit from tax-free retirement income, and the per diem tax exemption for private sector workers would rise from Sh2,000 to Sh10,000. The scrapping of the 1.5 percent Digital Service Tax is also a welcome relief for digital content creators.

But public trust remains fragile. Many citizens recall past promises of lower taxes and greater transparency, only to see new levies introduced and old ones rebranded. “We want to believe the government, but we’ve been here before,” said a university student in Kisumu.

Looking Ahead

As Parliament prepares to debate the bill, all eyes are on the next steps. Experts, business leaders, and government officials agree on one thing: the stakes are high. The final outcome will shape Kenya’s economic landscape for years to come.

For now, Kenyans are being urged to scrutinise the proposals, participate in the ongoing consultations, and make their voices heard. The Finance Bill 2025 may be a “clean-up” exercise, but for millions of Kenyans, it’s about much more than tax policy—it’s about the future of the country.

At the same time, Mr Mbadi has run into trouble with Senators after snubbing summons, saying he is “busy with other engagements”. The lawmakers said they would initiate a censure motion against him.

The latest development comes after the minister failed to appear before the Senate to answer questions concerning his ministry. He only informed the House of his absence, through a letter, 30 minutes to the start of the sittings.

The minister had also on Tuesday snubbed the Senate Finance and Budget Committee meeting to attend a political rally in Migori and later in the day, an interview with a local television.

Two months ago, senators warned CS Mbadi to stop treating the Senate as a village “baraza” where he can decide whether to appear before them or not.

This was after the minister snubbed the Senate Finance and Budget Committee invitation on the consideration of budget policy statements and medium term debt management strategies, telling the committee to refer to responses he had shared with a similar committee of the National Assembly.

On Wednesday, Senate Speaker Amason Kingi called on senators to invoke provisions of its Standing Order 51(d) to begin the process of censuring the “rogue” minister.

Speaker Kingi described the minister’s letter to the Senate as contemptuous as it did not indicate the reason why the minister was absent.

The CS had been summoned to answer questions concerning the status of pension disbursements to former MPs who served between 1979 and 1992, provide a breakdown of all taxes and levies imposed throughout the entire tea supply chain, as well as explain the delays in processing pension claims of retired civil servants.

Mr Kingi said the letter, dated May 6, was received at 9am, just 30 minutes to the start of the Wednesday morning sitting, and that the CS only said he had other official engagements.

The Standing Order provides that if a Cabinet Secretary fails to appear and respond to questions in the Senate without reasonable cause, the Senate can move a motion to censure the CS.

“You (senators) have a weapon to handle such kind of errant ministers according to Standing Order 51(d) of the Senate to send a clear message to the Executive,” said Mr Kingi.

“Time has come for you to invoke the provisions of the Standing Order and move a censure motion so that this Senate can regain its respect and ministers can acknowledge that this is a House that speaks for and on behalf of the people,” he added.

The Senate has, in particular, been embroiled in a tussle with certain CSs over their failure to appear before the House or committees to answer questions concerning their ministries.

The tough relationship stems from their constant snubbing of their invites with the enraged legislators who have often threatened to censure the ministers or fine them for non-appearance.